Post Office Sukanya Samriddhi Yojana Calculator

Plan your daughter’s future with the SSY scheme

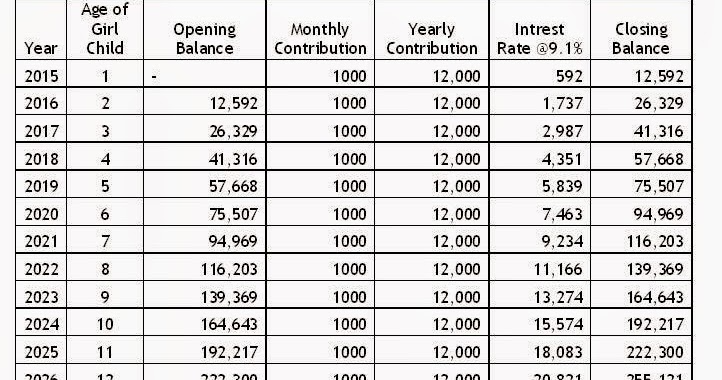

Projected Investment Returns

The Post Office Sukanya Samriddhi Yojana Calculator is an indispensable tool for parents and guardians planning long-term financial security for a girl child. Combining simplicity with the long-term benefits of a government-backed savings scheme, the Post Office Sukanya Samriddhi Yojana Calculator helps project how annual or monthly contributions grow over time under compound interest. This article explains the scheme’s history, objectives, implementation, state-level impact, real-life success stories, practical use of the Post Office Sukanya Samriddhi Yojana Calculator, challenges, comparisons with other schemes, and future prospects — all in one comprehensive, reader-friendly document.

Understanding the Post Office Sukanya Samriddhi Yojana Calculator and the Scheme

Launched as part of a nationwide initiative focused on girl-child welfare, the Sukanya Samriddhi Yojana (SSY) aims to encourage small savings and ensure financial security for girls. The Post Office Sukanya Samriddhi Yojana Calculator specifically models the behavior of deposits and interest over the life of an SSY account when the account is maintained at a post office. It is a planning instrument that helps parents decide how much to deposit regularly to meet future needs like higher education, marriage, or entrepreneurship.

The Post Office Sukanya Samriddhi Yojana Calculator converts inputs — such as the annual deposit amount, the duration of deposits, and the prevailing interest rate — into a projected maturity value. Because the Post Office administers numerous SSY accounts across rural and urban India, the Post Office Sukanya Samriddhi Yojana Calculator has become a preferred modeling option for many families who prefer to use the postal network.

Brief History and Policy Framework

The Sukanya Samriddhi Yojana was introduced to complement broader social welfare and women empowerment schemes. Its policy rationale was twofold: to boost household savings dedicated to girls and to reduce gender disparities in investment in education and health.

The scheme was integrated into the public savings architecture and distributed through two major channels — post offices and authorized banks. The Post Office Sukanya Samriddhi Yojana Calculator grew in prominence because India Post is often the most accessible banking service in rural and semi-urban locations; the calculator accommodates multiple deposit modalities (annual lump sums, periodic deposits) and yields calculations that reflect government-determined rates that are revised periodically.

Objectives and Key Features

Primary objectives of the Sukanya Samriddhi Yojana — and by extension the reason to use the Post Office Sukanya Samriddhi Yojana Calculator — include:

- Encouraging Savings: Promote a habit of saving specifically for girl children’s long-term needs.

- Targeted Financial Security: Provide a dedicated corpus for education, marriage, and other milestones.

- Safe, Government-Backed Returns: Offer comparatively stable returns backed by sovereign guarantee.

- Financial Inclusion: Leverage the postal network to reach underserved regions.

Key features commonly modeled in the Post Office Sukanya Samriddhi Yojana Calculator are the minimum and maximum deposit rules, the duration of deposits (typically up to 15 years after account opening), compounding frequency (annually), and premature withdrawal or partial withdrawal rules for education.

How the Post Office Sukanya Samriddhi Yojana Calculator Works — The Mathematics

Understanding the mathematics helps users interpret calculator outputs. The Post Office Sukanya Samriddhi Yojana Calculator uses compound interest principles with special consideration of deposit timing. A simple, practical formula used by many calculators is presented here.

Assume:

- A = annual deposit (if deposits are regular and equal)

- r = annual interest rate (expressed as a decimal; for example 0.07 for 7%)

- N = number of years deposits are made (commonly up to 15)

- M = total years until maturity, measured from account opening (commonly 21 years)

If deposits are made at the end of each year, the maturity value FV when deposits stop after N years but the account continues to earn interest until year M is:

FV = A * [ ( (1 + r)^M - (1 + r)^(M - N) ) / r ]

This formula sums the future value of each annual deposit, each compounded for the number of years remaining until maturity. The Post Office Sukanya Samriddhi Yojana Calculator applies this same structure whether the bank or post office administers the account; for monthly deposits, the calculator adjusts to monthly equivalents or converts monthly deposits into annualized contributions for simplicity.

Example (Illustrative Only)

For illustration, if a parent commits to an annual deposit of A rupees for 15 years with an annual interest rate r, and the maturity is at 21 years, the Post Office Sukanya Samriddhi Yojana Calculator will compute FV using the formula above. Note: interest rates are set by authorities and can change; the example above is only illustrative and not a current rate.

Practical Use: Step-by-Step with the Post Office Sukanya Samriddhi Yojana Calculator

Using a Post Office Sukanya Samriddhi Yojana Calculator effectively requires a few simple steps:

- Enter the girl’s birth date and account opening date so the calculator can determine how many years of deposits are permissible and the maturity date.

- Choose deposit frequency — annual lump sums, monthly deposits, or occasional lumps. Many calculators accept both monthly and annual entries and convert appropriately.

- Input expected annual contribution A or the monthly equivalent. The Post Office Sukanya Samriddhi Yojana Calculator can accept recurring values for each year if irregular contributions are planned.

- Input the current interest rate or choose a conservative assumed rate if planning for future uncertainties. The Post Office Sukanya Samriddhi Yojana Calculator will compute maturity values for several interest-rate scenarios to give a range of possible outcomes.

- Review partial withdrawal and maturity options. Calculators often show when partial withdrawals for higher education are permitted and how these withdrawals affect the final corpus.

- Evaluate results and run sensitivity analysis. Changing inputs in the Post Office Sukanya Samriddhi Yojana Calculator helps users evaluate trade-offs between deposit size and accumulated corpus.

Because rules such as maximum deposit limits and compounding intervals are defined by authorities, the Post Office Sukanya Samriddhi Yojana Calculator is best used with up-to-date scheme parameters when available.

State-Level Impact and Regional Analysis

The reach of SSY through the postal network has particular significance at the state and district level. A well-calibrated Post Office Sukanya Samriddhi Yojana Calculator can help policymakers and citizens compare state-level uptake, measure the regional distribution of benefits, and craft targeted awareness drives.

Rural vs Urban Penetration

In rural districts where bank branches are sparse, India Post often serves as the default financial access point. The Post Office Sukanya Samriddhi Yojana Calculator is relevant here because the post office accounts allow small, regular deposits that match rural saving patterns. State-wise, higher uptake in areas with strong postal networks reflects the synergy between financial inclusion efforts and social welfare delivery.

State-Specific Campaigns and Subsidies

Some states augment central schemes with local awareness programs or top-up benefits; the Post Office Sukanya Samriddhi Yojana Calculator can model scenarios that include hypothetical state-level top-ups or incentives, helping local administrators analyze fiscal impacts and potential returns for beneficiaries.

Measuring Outcomes

By aggregating outputs from many local Post Office Sukanya Samriddhi Yojana Calculator runs, administrators can estimate future flows of funds earmarked for female education and welfare, anticipate changes in school enrollment driven by secured funding, and evaluate long-term social impacts such as increased female labor force participation and reduced child marriage rates.

Success Stories and Real-Life Effects

Across districts where SSY has been actively promoted, families report measurable benefits, and several community-level success stories illustrate the scheme’s transformative potential. These narratives also highlight the role of the Post Office Sukanya Samriddhi Yojana Calculator as a planning partner.

- From small deposits to higher education: A family in a semi-urban district used the Post Office Sukanya Samriddhi Yojana Calculator to set a modest monthly target. Over time, the calculable predictability of the corpus allowed the family to confidently enroll their daughter in a professional degree program without external debt.

- Rural entrepreneurship enabled: In another instance, a rural household used the Post Office Sukanya Samriddhi Yojana Calculator to plan for vocational training at maturity, enabling their daughter to start a small tailoring business that provided sustainable income.

- School retention through assured funds: In areas with targeted outreach, the Post Office Sukanya Samriddhi Yojana Calculator was used in community workshops to show families how small, consistent savings could finance secondary and tertiary education, improving school retention for girls.

These stories emphasize the calculator’s role not merely in projecting numbers but in building confidence and long-range planning.

Challenges and Limitations

Despite clear advantages, the Sukanya Samriddhi Yojana and the Post Office Sukanya Samriddhi Yojana Calculator face several challenges:

Interest Rate Volatility and Policy Changes

Interest rates for government savings products are periodically revised. The Post Office Sukanya Samriddhi Yojana Calculator can model scenarios, but any projections depend heavily on future rate assumptions. Users must remember that actual outcomes will change if policy rates change.

Awareness and Financial Literacy

Many potential beneficiaries lack awareness or the basic financial literacy to use the Post Office Sukanya Samriddhi Yojana Calculator effectively. Outreach and user-friendly tools in local languages are required to bridge this gap.

Access and Administrative Friction

Although India Post has broad reach, operational delays, physical documentation, and the need for paper-based submissions in some areas impede program uptake. The Post Office Sukanya Samriddhi Yojana Calculator is only useful if combined with streamlined account opening and deposit mechanisms.

Behavioral Barriers

Keeping up with regular deposits over 15 years requires commitment. Families experiencing income volatility may struggle to maintain consistent contributions; while the Post Office Sukanya Samriddhi Yojana Calculator helps visualize the end benefits, it cannot eliminate behavioral hurdles.

Partial Withdrawals and Educational Disruptions

Though partial withdrawals for education are permitted under rules, accessing funds during emergencies can be complicated, and premature withdrawals may reduce the final corpus. The Post Office Sukanya Samriddhi Yojana Calculator can show the long-term cost of early withdrawals, but families still need safety nets.

Comparisons with Other Savings and Education Schemes

For parents assessing options, it helps to compare SSY using the Post Office Sukanya Samriddhi Yojana Calculator with other common instruments: Public Provident Fund (PPF), bank fixed deposits, children’s insurance plans, and recurring deposit schemes.

Sukanya Samriddhi Yojana vs PPF

- Purpose: SSY is targeted for girl children; PPF is a general long-term savings scheme.

- Lock-in and Maturity: SSY offers a clear social objective and maturity tied to girl-child milestones; PPF offers a 15-year maturity with extensions.

- Access Points: Post Office SSY can be held at postal counters, while PPF is typically at banks and post offices.

- Comparison via calculator: The Post Office Sukanya Samriddhi Yojana Calculator highlights that for targeted girl-child savings, SSY’s policy design and withdrawal rules may be more favorable than PPF for certain goals, especially where the aim is a guaranteed corpus for education.

Sukanya Samriddhi Yojana vs Bank Recurring Deposits and Fixed Deposits

- Risk and Return: Bank deposits may offer lower but stable returns; SSY is sovereign-backed and often competitive.

- Liquidity: Bank products typically allow earlier withdrawal (with penalties); SSY has more restrictions designed to preserve funds for the child.

- When to use the calculator: The Post Office Sukanya Samriddhi Yojana Calculator helps quantify how much more (or less) desirable SSY is relative to bank instruments for a particular long-term goal.

Sukanya Samriddhi Yojana vs Insurance + Investment Plans

- Complexity and Costs: Insurance-cum-investment plans add insurance benefits but often carry higher fees and complexity.

- Simplicity of SSY: SSY and the Post Office Sukanya Samriddhi Yojana Calculator offer direct, transparent projection without hidden charges, making them accessible to lower-income households.

Designing a Responsible Deposit Strategy Using the Post Office Sukanya Samriddhi Yojana Calculator

A responsible strategy takes into account household cash flows, educational aspirations, and risk appetite.

- Start Early: Early account opening increases compounding years. The Post Office Sukanya Samriddhi Yojana Calculator shows how starting even a few years earlier can significantly boost maturity value.

- Automate Deposits Where Possible: Link savings to predictable inflows — the calculator demonstrates the benefit of regular deposits versus erratic deposits.

- Run Scenario Analysis: Use the Post Office Sukanya Samriddhi Yojana Calculator to model outcomes under different deposit sizes and rate assumptions.

- Pair with Emergency Savings: Don’t use SSY as an emergency fund; maintain a liquid buffer separately. The calculator can show how withdrawals affect long-term goals.

- Plan for Educational Milestones: Decide whether the corpus will be used for higher education, skill training, or marriage; the calculator can produce a clear target corpus to guide deposit decisions.

Integrating the Post Office Sukanya Samriddhi Yojana Calculator into Policy and Community Programs

Government agencies and NGOs can leverage the Post Office Sukanya Samriddhi Yojana Calculator to design outreach materials, estimate fiscal impacts, and tailor communications. Schools, gram panchayats, and community centers can host sessions demonstrating the calculator to families, showing how small monthly contributions compound into substantial sums. At the state level, aggregating calculator outputs can forecast future demand for educational subsidies or scholarships.

Technology and Digital Access: Making the Post Office Sukanya Samriddhi Yojana Calculator More Accessible

To increase adoption, the Post Office Sukanya Samriddhi Yojana Calculator should be integrated into mobile banking apps, India Post websites, and offline kiosks in local languages. An easy-to-use calculator with graphical outputs, downloadable statements, and scenario comparison features will help bridge the financial literacy gap. Integrating SMS alerts and reminders with calculator-generated targets can further support discipline in saving.

Monitoring Success: Metrics and Evaluation

To measure the success of SSY and the Post Office Sukanya Samriddhi Yojana Calculator’s role in policy, administrators should monitor:

- Account uptake rates by district and socio-economic group.

- Average annual deposit size and persistence over time.

- Percentage of accounts reaching full maturity and actual utilization at maturity (education vs. marriage vs. other uses).

- Impact on female education metrics such as school completion rates and higher-education enrollment.

- Incidence of premature withdrawals and reasons.

These indicators help policymakers refine outreach and adapt the calculator to reflect realistic depositor behavior.

Future Prospects and Innovations

Looking ahead, the Post Office Sukanya Samriddhi Yojana Calculator can evolve in several directions:

- Dynamic Rate Modeling: Since interest rates can change, calculators can offer dynamic simulations that factor in projected interest-rate paths and policy scenarios.

- Integration with Other Schemes: Interoperability with scholarship portals and educational loan platforms could guide beneficiaries on the optimal mix of funding sources.

- Behavioral Nudges: Push notifications, milestone badges, and gamified progress trackers can improve deposit persistence.

- AI-driven Personalization: Advanced calculators can recommend personalized deposit strategies based on household income profiles and educational goals.

- Offline-First Tools: For remote areas, downloadable PDFs or USSD-based calculator flows can broaden reach without requiring robust internet access.

These innovations would sharpen the Post Office Sukanya Samriddhi Yojana Calculator’s utility as a practical planning instrument and a policy tool.

Responsible Messaging: What the Calculator Cannot Promise

The Post Office Sukanya Samriddhi Yojana Calculator is a projection tool, not a guarantee. It cannot predict future policy changes, interest-rate revisions, or events that may force early withdrawals. Users should treat calculator outputs as planning guidance, supplement savings with contingency funds, and seek official updates on scheme parameters when making definitive financial commitments.

How to Interpret Common Outputs from the Post Office Sukanya Samriddhi Yojana Calculator

When you use the calculator, you’ll typically see:

- Projected Maturity Value: The total corpus at maturity, assuming deposits and rates remain as entered.

- Total Deposits: The sum of all deposits made — this allows comparison of contributions versus earnings.

- Interest Earned: The difference between the maturity value and total deposits, showing the power of compounding.

- Year-by-Year Schedule: Some calculators show a schedule of balances, which helps track annual targets.

- Withdrawal Impact: If you simulate withdrawals for education, the calculator can display the reduced final corpus.

Interpreting these outputs helps families decide how much to increase deposits to meet specific educational costs or other milestones.

Governance and Consumer Protection

Because SSY is government-backed, the Post Office Sukanya Samriddhi Yojana Calculator must be complemented by strong consumer protection measures: clear disclosures, up-to-date official rate announcements, and simplified grievance redressal at the post office level. The public trust in the postal network is a strength, but transparency and timely information are essential to ensure families rely on accurate calculator inputs.

Practical Checklist Before Using the Post Office Sukanya Samriddhi Yojana Calculator

Before entering your numbers, prepare:

- The child’s birth date and intended account opening date.

- A realistic estimate of how much you can save monthly or annually.

- A conservative choice for the assumed interest rate (acknowledging that actual rates can change).

- An emergency fund plan so you are not forced to withdraw from SSY prematurely.

- Official confirmation of scheme rules from a post office or government website for current parameters.

Case Study: Modeling an Educational Goal with the Post Office Sukanya Samriddhi Yojana Calculator (Hypothetical)

Consider a guardian planning for a daughter’s university fee at age 18. Using the Post Office Sukanya Samriddhi Yojana Calculator, the guardian inputs:

- Annual deposit commitment,

- Timeline until maturity,

- Assumed interest rate,

- Number of years deposits will be made.

The calculator outputs a target corpus and shows whether current savings will match projected university costs at prevailing estimates. The guardian then adjusts deposit amounts or seeks supplementary funding sources if the calculated corpus falls short.

Practical Tips for Post Office Staff and Community Workers

Staff at post offices and community workers can enhance uptake by:

- Demonstrating the Post Office Sukanya Samriddhi Yojana Calculator during account opening.

- Providing printed scenario sheets showing common deposit plans.

- Running community workshops using the calculator to show how small monthly savings accumulate.

- Helping families download calculator outputs for future reference.

Such supports reduce friction and enhance trust in the scheme.

Equity Considerations and Women Empowerment Outcomes

The Post Office Sukanya Samriddhi Yojana Calculator is more than a financial tool — it is a mechanism that supports equity. By enabling predictable savings for girls, it can:

- Increase school completion rates.

- Reduce dependence on early marriage as a financial coping strategy.

- Enable investments in female education and entrepreneurship.

- Provide a tangible financial identity to girls at maturity, which can be empowering.

The calculator helps make these long-term outcomes visible and actionable for families and policymakers.

Conclusion

The Post Office Sukanya Samriddhi Yojana Calculator is an accessible, powerful planning instrument that aligns financial discipline with social objectives. Whether you are a parent thinking about your daughter’s education, a community worker designing outreach, or a policymaker evaluating state-level impacts, the calculator helps translate small, regular contributions into meaningful future security.

Used responsibly, combined with financial literacy and an emergency buffer, the Post Office Sukanya Samriddhi Yojana Calculator can be the catalyst that transforms modest savings into empowerment and opportunity. It offers transparency, planning clarity, and aligns with broader state-wise benefits and women empowerment schemes — contributing to rural development and social welfare initiatives across the nation.