SBI Sukanya Samriddhi Yojana Calculator

Plan your daughter’s future with SSY scheme

Projected Investment Returns

SBI Sukanya Samriddhi Yojana Calculator — when planning a secure, tax-efficient future for a girl child, this phrase should be on every parent’s radar. The Sukanya Samriddhi Yojana (SSY) is one of India’s flagship small-deposit government savings schemes targeted at the girl child. Banks such as the State Bank of India provide dedicated tools — the SBI Sukanya Samriddhi Yojana Calculator — to estimate maturity amounts, visualize contribution schedules, and design a savings path that aligns with education, marriage, or long-term goals. This article explains the scheme end-to-end: its history, objectives, eligibility rules, implementation mechanics, state-level impact, success stories, operational challenges, comparisons with other schemes, and future prospects — with practical guidance on using the SBI Sukanya Samriddhi Yojana Calculator to plan real-life outcomes.

Why an SBI Sukanya Samriddhi Yojana Calculator matters

For many households the difficult part is not the decision to save, but knowing how much to save, how frequently, and what the eventual corpus will be. The SBI Sukanya Samriddhi Yojana Calculator is a purpose-built financial planning tool that transforms inputs (monthly or annual deposit, rate of interest, and tenure) into an expected maturity amount, showing principal, interest earned, and total corpus.

Rather than relying on rough mental estimations, guardians can use the SBI Sukanya Samriddhi Yojana Calculator to assess alternative deposit patterns, check the effect of compounding at different interest rates, and align monthly cash flows with long-term goals. The tool is particularly useful because the SSY interest rate is set by the Government and reviewed periodically; a calculator helps simulate variations and shows the sensitivity of final returns to interest-rate movement. State Bank of India+1

A short history: how Sukanya Samriddhi Yojana started and evolved

The Sukanya Samriddhi Yojana was announced as part of India’s broader ‘Beti Bachao, Beti Padhao’ initiative and rolled out to encourage savings for girls’ education and marriage. Introduced to provide a long-horizon, safe investment vehicle, SSY quickly became popular because it combines guaranteed returns with tax benefits under Section 80C and tax-free maturity proceeds under Section 10 of the Indian Income Tax Act (subject to prevailing tax rules). Over the years, account access widened to authorized bank branches and post offices to ensure reach in both urban and rural areas. Official information and scheme rules are published and updated by government portals and participating institutions, ensuring transparency and a wide distribution network. India Government+1

Objectives of the scheme

The SSY is a policy instrument with clearly stated objectives:

- Promote financial security and dignity for the girl child.

- Create a designated, long-term savings corpus for education and marriage.

- Offer a low-risk, government-backed return with tax incentives to incentivize disciplined saving.

- Encourage social goals such as girls’ education and gender parity by making financial planning for daughters straightforward and attractive.

These objectives make SSY not just a financial product but also a social policy lever designed to change saving behavior while addressing structural gender imbalances in access to resources.

Key features and rules you should know before using the SBI Sukanya Samriddhi Yojana Calculator

Before you start punching numbers into the SBI Sukanya Samriddhi Yojana Calculator, it’s important to understand the scheme’s parameters:

- Who can open the account: A parent or legal guardian can open an SSY account in the name of a girl child who is below 10 years of age. Only resident Indian girls are eligible. Guardians may open accounts for up to two girls (with exceptions for twins/triplets as per rules). Axis Bank+1

- Minimum and maximum deposits: The minimum deposit is very modest (₹250), while the annual maximum deposit limit is ₹1.5 lakh (per financial year). These caps help keep the product accessible while allowing significant accumulation for disciplined savers. NSI India

- Tenure and partial withdrawal: The account matures 21 years from the date of opening, but partial withdrawals for higher education are allowed after the girl reaches 18 (subject to proof and conditions). The guardian can operate the account until the girl attains majority.

- Interest rate: The interest rate is set by the Government and is reviewed periodically — typically quarterly. Recent quarters have seen competitive rates that make SSY one of the higher-yielding safe instruments in the small-deposit category. Use the SBI Sukanya Samriddhi Yojana Calculator to model interest-rate scenarios because the final corpus is sensitive to periodic rate changes. Groww+1

- Tax treatment: Contributions qualify under Section 80C up to the applicable limit; interest and maturity proceeds are tax-free under prevailing rules, making SSY highly tax-efficient.

- Where to open: Authorized bank branches (including SBI) and post offices, with simple KYC and supporting documentation.

These scheme rules form the basis of what the SBI Sukanya Samriddhi Yojana Calculator uses as inputs and constraints.

How the SBI Sukanya Samriddhi Yojana Calculator works (practical mechanics)

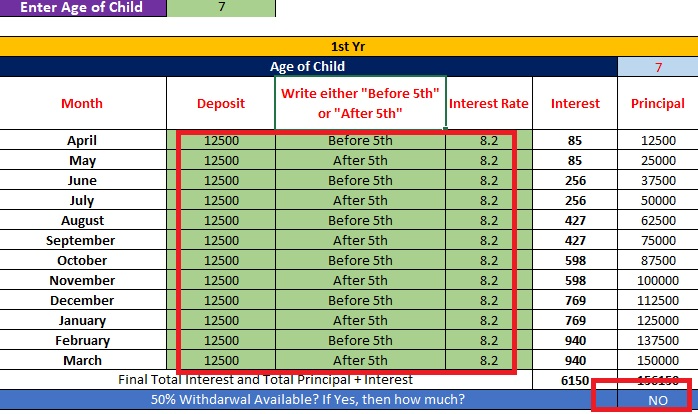

At its core, the SBI Sukanya Samriddhi Yojana Calculator uses standard compound interest math to calculate maturity amounts from yearly or periodic deposits. Typical calculators (like SBI’s) let you enter:

- Deposit frequency and amount: Monthly, quarterly, half-yearly, or annual contributions.

- Rate of interest: Current notified SSY rate (or a custom rate for hypothetical scenarios).

- Deposit term: Number of years you plan to keep making contributions.

- Maturity term: Total duration till maturity (the scheme term is effectively 21 years from account opening).

The formula is a straightforward application of compound interest for recurring deposits, taking into account the compounding frequency. Calculators then sum the contributions plus interest accrued each period to provide a maturity estimate, total interest earned, and a schedule of annual contributions — invaluable for budgeting and goal planning. Many calculators also present an amortization-like schedule showing year-by-year contributions and accumulated balance. State Bank of India+1

Step-by-step: Using the SBI Sukanya Samriddhi Yojana Calculator effectively

- Gather facts first. Note the girl child’s current age, the date you intend to open the account, and how much you can comfortably deposit each month/annum.

- Check the current SSY interest rate. This is available on official channels or bank sites and is required by the SBI Sukanya Samriddhi Yojana Calculator as an input. Because rates change quarterly, check the rate at the time of calculation. Groww

- Choose deposit frequency. Decide whether monthly SIP-like deposits or yearly lumps will match your cash flows. The SBI Sukanya Samriddhi Yojana Calculator supports multiple frequencies; compare outcomes for monthly vs annual contributions to see which fits your budget. State Bank of India

- Run scenarios. Use the SBI Sukanya Samriddhi Yojana Calculator to run multiple scenarios: (a) minimum deposit pathway, (b) moderate monthly deposit that balances household cash flow and corpus, and (c) higher-but-limited yearly lumps to reach an aggressive goal.

- Plan for contingencies. Compare scenarios with slightly higher and lower interest rates to understand the scheme’s sensitivity to rate changes. Because the SSY rate is government-determined, simulate a +/- 0.5–1.0% shift to test robustness.

- Lock in and review annually. Once you have a plan, open the account and review your progress annually (or when rates change), adjusting contributions if necessary.

Sample calculation — an illustration with SBI Sukanya Samriddhi Yojana Calculator logic

Imagine a parent uses the SBI Sukanya Samriddhi Yojana Calculator to plan for a newborn daughter. They plan to deposit ₹2,000 monthly (₹24,000 annually), and the current SSY rate for modelling is 8.2% (use the then-current rate shown by official sources when you calculate). The SBI Sukanya Samriddhi Yojana Calculator will compound monthly (or as per the selected frequency), accumulate principal and interest over the years you choose to deposit, and then show the 21-year maturity amount.

Such step-by-step examples are useful because they reveal how modest but disciplined contributions convert into significant, tax-free corpus at maturity.

State-level impact and regional dynamics

Sukanya Samriddhi Yojana is a national scheme, but its penetration and impact differ across states and regions. Rural districts often benefit more in social terms because the scheme incentivizes saving and safeguards funds that might otherwise be consumed for daily needs. In states with higher female literacy and stronger social outreach—where ‘Beti Bachao, Beti Padhao’ campaigns have stronger traction—uptake has been higher. Financial inclusion measures (bank branches, post office reach, and CSR-driven awareness programmes) also influence how many families open SSY accounts and keep them active.

When using the SBI Sukanya Samriddhi Yojana Calculator, regional planners can model adoption scenarios to estimate how an outreach campaign or a subsidy could affect the aggregate savings pool in a district. For example, microfinance linkage and local banks’ awareness drives can increase account openings; the SBI Sukanya Samriddhi Yojana Calculator helps planners quantify potential flows and expected future expenditures for girl-child welfare programs.

How SSY complements state-level women empowerment schemes and social welfare initiatives

SSY doesn’t operate in isolation. In many states, SSY is part of a broader ecosystem — conditional cash transfers, scholarship schemes, nutritional programs, and educational support for girls. The corpus created through SSY can directly finance higher education in state colleges or private institutions, reducing dropout risks. Linking SSY with other state initiatives (for example, scholarship top-ups for families that maintain regular SSY contributions) has been piloted or proposed in places as a way to tie savings behaviour to educational outcomes.

From a policy-design perspective, the SBI Sukanya Samriddhi Yojana Calculator is a bridge between household-level financial decisions and state-level expectations: it quantifies the likely resources families will have for schooling and helps policymakers craft complementary interventions.

Success stories and real-world anecdotes

Across India there are documented cases where disciplined SSY savings transformed a family’s ability to finance education or defray marriage costs without dipping into other household reserves. Rural mothers who used the SBI Sukanya Samriddhi Yojana Calculator to plan modest monthly deposits often report that the discipline of an automated plan and the visibility of a calculator-driven projection made it psychologically easier to persist with savings. NGO-led financial-literacy workshops in villages have used the SBI Sukanya Samriddhi Yojana Calculator in training sessions to show stepwise growth and motivate parents.

These success stories show how a transparent projection tool, tied to a trustworthy government-backed product, changes saving behavior and helps families see the long-run benefits of consistent, small contributions.

Common implementation challenges and how to mitigate them

While SSY is effective, it faces implementation hurdles:

- Awareness gaps: Not all households know about SSY or understand its benefits. Solution: systematic financial-literacy drives, township-level counselling, and integration into maternal and child welfare outreach.

- Cash-flow pressures: Low-income households may find even modest monthly deposits difficult. Solution: flexible deposit options and social support tied to SSY using conditional grants can help. The SBI Sukanya Samriddhi Yojana Calculator can model very small deposits (minimum ₹250) to show long-term outcomes, which helps set realistic expectations. Navbharat Times

- Account inactivity: Families sometimes stop contributing after initial enthusiasm. Reminders, linkage to recurring payment facilities, and digital mandates reduce dropouts. The SBI Sukanya Samriddhi Yojana Calculator can show what stopping contributions early does to the final corpus, reinforcing the value of continuity.

- Documentation and access in remote regions: Though post offices help, remote communities occasionally face barriers in documentation and bank access. Mobile outreach camps and simplified KYC processes can address this.

By using the SBI Sukanya Samriddhi Yojana Calculator to create visible, believable goals, many implementation frictions can be softened through clearer expectations.

Comparing Sukanya Samriddhi Yojana with alternative schemes

To judge SSY properly, compare it with other popular instruments:

- Public Provident Fund (PPF): Longer tenure (15 years) and steady government-backed returns; PPF offers flexibility for adults rather than child-specific goals. SSY is child-targeted and offers similar safety plus the social objective of supporting girls.

- Recurring Deposits (RDs) in banks: RDs allow monthly savings with compounding, but they lack SSY’s tax advantages and policy focus. RDs can complement SSY for liquidity management.

- Fixed Deposits (FDs): Provide short-to-medium term certainty but are taxable on interest; SSY’s tax-free maturity and higher effective yield (post-tax) often make it more attractive for long horizon goals than an FD.

- Equity-linked plans or mutual funds: Potentially higher returns but higher volatility; these are suitable for parents with longer horizon and risk appetite. SSY remains the low-risk conservative core of a girl-child education/marriage portfolio.

Using the SBI Sukanya Samriddhi Yojana Calculator alongside calculators for PPF, RDs, and mutual funds gives a composite picture of portfolio design: SSY as the safe core and other instruments to add risk-return diversification.

Financial planning tips — integrating the SBI Sukanya Samriddhi Yojana Calculator into a household plan

- Set priority goals: Use the SBI Sukanya Samriddhi Yojana Calculator to convert education cost estimates into target corpus amounts.

- Create a laddered strategy: Start with a base SSY contribution (using the SBI Sukanya Samriddhi Yojana Calculator to determine the minimum to reach target) and layer additional mutual fund SIPs for inflation-beating returns.

- Automate: Use auto-debit features to ensure timely contributions. Automation reduces missed deposits and builds compounding power.

- Insurance-protect the plan: Ensure there is adequate life and critical illness cover for the primary earner; this prevents the savings plan from being derailed by shocks.

- Revisit annually: Interest rates and family circumstances change — use the SBI Sukanya Samriddhi Yojana Calculator yearly to re-run projections and adjust deposits.

The role of digital tools and SBI’s online calculator ecosystem

Banks, led by SBI, have made online calculators easily accessible for customers. SBI’s own Sukanya Samriddhi Account calculator is an example: it allows the user to input installment amount, choose frequency, set the rate of interest, and get an indicative maturity figure. These calculators underscore the transparency of the scheme — the bank prominently notes that maturity estimates are indicative and subject to government-notified interest rates. For those seeking to plan carefully, SBI Sukanya Samriddhi Yojana Calculator tools, combined with official rate notifications and bank advice, make planning both scientific and user-friendly. State Bank of India+1

Regulatory updates and interest-rate behavior — what practitioners watch

SSY interest is influenced by government decisions tied to yields on government securities. Typically the rate is reviewed quarterly, and the government publishes the applicable rate. Since the final corpus is highly sensitive to the stated rate (even small rate changes compound significantly over 21 years), parents and planners track quarterly interest announcements and update projections via the SBI Sukanya Samriddhi Yojana Calculator accordingly. Historical stability and the government guarantee remain major advantages compared to market-linked products. Groww+1

Addressing misinformation and myths

Common myths include: “You must deposit the maximum ₹1.5 lakh each year” — False. SSY is flexible; the minimum deposit is just ₹250, and you can choose a level that fits your budget. “If I miss a year it is lost” — also false; accounts can be revived with penalty for missed years under prescribed rules. Use the SBI Sukanya Samriddhi Yojana Calculator to model missed contributions and revival strategies so you have a realistic plan if life intervenes.

Practical checklist before opening an account (and while calculating)

- Confirm the girl’s age (below 10 at account opening).

- Complete KYC for the guardian and the child as required by the bank/post office.

- Decide deposit frequency and run the SBI Sukanya Samriddhi Yojana Calculator for conservative, moderate, and aggressive plans.

- Keep digital records and enable auto-debit where feasible.

- Document the account in your household financial plan so contributions are treated as a priority.

Future prospects: where the scheme can go next

SSY’s future improvements could include:

- Better integration with digital education platforms and scholarship schemes.

- Incentives for low-income households (top-up matching or conditional benefits).

- Easy transfer protocols for migrating accounts across banks as customers’ banking relationships evolve.

- Stronger linkage with financial literacy curriculums so the SBI Sukanya Samriddhi Yojana Calculator becomes a staple educational tool in community programs.

These enhancements would increase adoption and deepen SSY’s role as a core instrument in girls’ financial security.

Using the SBI Sukanya Samriddhi Yojana Calculator in policymaking and program design

Planners and NGOs can use the SBI Sukanya Samriddhi Yojana Calculator to estimate aggregated impacts of targeted interventions. For example: if a local authority offers a one-time entry incentive or a small top-up for low-income families that open SSY accounts, the calculator helps compute the aggregate future benefit and cost-effectiveness of the program in improving educational outcomes.

FAQs — Practical answers every parent and guardian needs

Final checklist: actions to take right now

- Visit the official SBI Sukanya Samriddhi Yojana Calculator or a trusted financial portal and run at least three scenarios (conservative / balanced / aggressive). State Bank of India+1

- Decide on deposit frequency that matches household cash flows.

- Open the account at an SBI branch or post office after confirming documentation and age eligibility. NSI India

- Automate debits and schedule annual reviews to adjust for policy-rate changes or family needs.

Closing thoughts

The phrase SBI Sukanya Samriddhi Yojana Calculator signals more than a technical tool — it stands for disciplined planning, transparency, and the empowerment of saving for girls’ futures. Whether you are a parent, a policymaker, or a community worker, using the SBI Sukanya Samriddhi Yojana Calculator gives you a practical, data-driven way to turn intention into a credible financial plan. Coupled with the scheme’s government guarantee, tax benefits, and long-term horizon, SSY should be part of every comprehensive plan for a girl child’s education and financial security. Begin with a realistic estimate today, and let the compounding of time, discipline, and policy support transform small deposits into life-changing opportunities.

Selected sources and tools referenced in this article: official Government of India scheme pages and State Bank of India calculator pages provide the authoritative scheme description and online calculator; independent financial portals and banks provide illustrative calculators and current-rate summaries to help plan scenarios. For immediate calculations, use SBI’s Sukanya Samriddhi Account Calculator on the bank website. Angel One+4India Government+4State Bank of India+4