Sukanya Samriddhi Yojana Interest Calculator

Estimate the growth of your SSY investment

Projected Investment Returns

Sukanya Samriddhi Yojana Interest Calculator is more than a digital tool — it is the planning bridge between a parent’s financial intent and a girl child’s secure future. Launched as a focused effort to promote savings for girls and reinforce gender-equitable welfare, Sukanya Samriddhi Yojana (SSY) has become one of India’s most trusted small-savings instruments. Using a Sukanya Samriddhi Yojana Interest Calculator helps families estimate the corpus they will have at maturity, understand interest accrual under prevailing rates, and design realistic periodic contributions. This long-form guide explains the scheme’s history, objectives, operation, state-level impact, comparative advantages, challenges, practical usage of a Sukanya Samriddhi Yojana Interest Calculator, and forward-looking prospects — empowering you to make an informed decision.

Why a Sukanya Samriddhi Yojana Interest Calculator matters

Financial planning requires clarity: how much will regular deposits grow over time, what interest will the government credit, and when can withdrawals be made? A Sukanya Samriddhi Yojana Interest Calculator answers those questions in plain numbers. It helps translate policy parameters — interest rate, compounding frequency, deposit limits, and tenure — into a maturity figure you can plan around. Because the scheme’s interest rate is reviewed periodically by the Government of India and compounded annually, a reliable Sukanya Samriddhi Yojana Interest Calculator that uses the current notified rate is essential for accurate projections. As of the current quarter, the SSY interest rate is set by the government and widely reported at 8.2% per annum (compounded yearly). India Bonds+1

A quick primer: What is the Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana is a small-savings scheme targeted at promoting the education and financial security of the girl child. Launched under the “Beti Bachao, Beti Padhao” umbrella, SSY allows parents or legal guardians to open an account in the name of a girl child (up to a specified maximum age) and deposit annually for a specified period. The account earns a government-notified interest rate compounded annually, and offers tax advantages that make it an attractive, low-risk saving vehicle.

Key operational features include: accounts may be opened for a girl child up to 10 years of age; the minimum annual contribution is ₹250 and the maximum eligible deposit in a financial year is ₹1.5 lakh; deposits are allowed for 15 years from the account opening date, while the account matures after 21 years. These operational rules are defined in government notifications and detailed on the National Small Savings portal and post office guidance. NSI India+1

The origin and objectives: a brief history

Sukanya Samriddhi Yojana was announced in January 2015 as a central government initiative to encourage parents to build a corpus for their daughters’ education and marriage. The scheme’s goals were explicit: increase the rate of savings earmarked for girl children, incentivize families to invest in girls’ education, and provide a safe, government-backed instrument with tax efficiency. Ten years since its introduction, SSY has seen widespread uptake, with millions of accounts opened across states in post offices and authorized banks — making it one of the hallmarks of India’s social welfare savings architecture. Official communications and scheme summaries from the government document the scheme’s scale and outreach. Press Information Bureau

How the Sukanya Samriddhi Yojana Interest Calculator works: the math behind the numbers

At its core, a Sukanya Samriddhi Yojana Interest Calculator applies compound interest mathematics to a stream of annual deposits. The standard formula for compounding a single deposit is:

A = P × (1 + r/n)^(n×t)

where:

- A = amount after time t,

- P = principal (deposit),

- r = annual interest rate (in decimal form),

- n = number of compounding periods per year (SSY compounds annually, so n = 1),

- t = time in years.

Since SSY typically involves a sequence of annual contributions (for up to 15 years) with interest compounding until maturity at year 21, the calculator sums each contribution’s compounded value at maturity. A practical Sukanya Samriddhi Yojana Interest Calculator allows you to input the annual deposit profile (fixed annual deposit, monthly equivalent, or custom yearly deposits), the prevailing SSY interest rate, and the account opening year; it then computes the maturity corpus, total interest earned, and the effective annualized return. Financial portals and bank calculators implement this logic behind the scenes. Groww+1

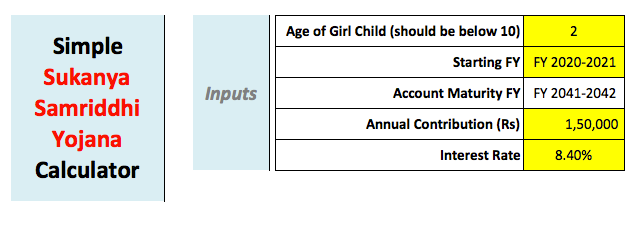

Step-by-step: Using a Sukanya Samriddhi Yojana Interest Calculator

- Enter the current interest rate: Use the government-notified rate (a Sukanya Samriddhi Yojana Interest Calculator should default to the latest quarter’s rate). As noted earlier, the current rate reported for the July–September quarter is 8.2% per annum, compounded yearly. India Bonds

- Define your contribution schedule: Decide whether you will deposit a fixed annual sum (for example, ₹25,000 per year), deposit monthly equated sums, or vary contributions over the 15-year deposit window.

- Specify the deposit period and maturity date: Remember that deposits are allowed only for 15 years from account opening, but interest continues to accrue until the account matures at 21 years.

- Run the calculation: The Sukanya Samriddhi Yojana Interest Calculator aggregates the compounded value of each contribution to deliver the maturity corpus, total contributions, and total interest earned.

- Interpret the results and plan withdrawals: The account allows partial withdrawal rules (for higher education) after the girl turns 18; plan for prospective education costs and tax considerations accordingly.

Using such a Sukanya Samriddhi Yojana Interest Calculator converts abstract policy parameters into practical targets you can plan around.

Practical example (conceptual) — how projections change with deposits

Imagine you plan to deposit ₹50,000 annually into an SSY account at an 8.2% annual interest rate. A Sukanya Samriddhi Yojana Interest Calculator will compute how each year’s deposit compounds until the 21-year maturity, giving you the total maturity corpus. Financial calculators online from banks and investment portals implement this exact logic and let you compare scenarios: lower annual contributions, higher one-time deposits, or a gradual increase in yearly deposits as income grows. Tools from major banks and financial platforms provide ready calculators for this purpose. HDFC Bank+1

Interest rate policy: who sets it and how often it changes?

Interest rates for small savings schemes including Sukanya Samriddhi Yojana are set by the Government of India and are reviewed quarterly. The rates are linked to government securities yields and are intended to balance returns for retail savers with the government’s cost of borrowing. Because the rate is subject to periodic recalibration, a Sukanya Samriddhi Yojana Interest Calculator must always reflect the latest notified rate for accurate estimates. Quarter-by-quarter changes are published and reported in financial media; for the latest quarter, the SSY rate was maintained at 8.2% per annum. Groww+1

Deposits, limits, and tax treatment — the rules you must know

Operationally, SSY has clear numeric rules that affect calculations:

- Age limit for account opening: A Sukanya Samriddhi Yojana account can be opened for a girl child up to 10 years of age. That makes the timing of the first deposit an important determinant of maturity benefits. NSI India

- Deposit window and maturity: Deposits may be made for 15 years from the date of opening; the account matures 21 years from account opening. Interest, however, continues to accrue even in the post-deposit period until maturity. Indian Bank

- Minimum and maximum deposits: Minimum deposit is ₹250; the annual maximum is ₹1.5 lakh. This cap matters for planning and for the Sukanya Samriddhi Yojana Interest Calculator because contributions above ₹1.5 lakh per financial year will not be accepted for tax deduction or account credit. NSI India

- Taxation: Contributions to SSY qualify for deduction under Section 80C of the Income Tax Act (subject to the overall ₹1.5 lakh limit under Section 80C). Interest earned and the maturity proceeds are tax-exempt (i.e., SSY is EEE — Exempt at contribution, Exempt on accrual, Exempt on maturity). This makes the Sukanya Samriddhi Yojana Interest Calculator outputs effectively tax-free in most use cases, and significantly increases the appeal of the scheme relative to taxable instruments. HDFC Bank

These rules are the input constraints for any meaningful Sukanya Samriddhi Yojana Interest Calculator and must be respected when preparing a financial plan.

State-level outreach and impact: how SSY changed regional savings behaviour

Sukanya Samriddhi Yojana has been actively promoted across states through post offices, banks, and state-run awareness campaigns under Beti Bachao Beti Padhao. The scheme’s outreach has been significant in both urban and rural areas, but its traction in certain states has uniquely influenced savings patterns:

- Rural penetration: In rural areas, where traditional savings were often informal, SSY provided a formal, guaranteed return with a social objective. Parents who previously relied on either gold savings or informal instruments began using SSY as a disciplined vehicle for daughters’ futures.

- State social-welfare tie-ins: Several state governments and municipalities have used SSY as a recommended instrument when disbursing girl-child stipends or bond transfers, thereby amplifying the corpus for marginalised families.

- Banking network effect: Because SSY can be opened at India Post and at authorized banks, regional postal networks played a role in spreading the scheme, particularly in areas where banking density is low. The scheme’s performance and adoption figures are tracked in government communiqués and local financial inclusion reports. Press Information Bureau+1

Across states, the Sukanya Samriddhi Yojana Interest Calculator has become a standard planning tool in financial literacy drives: educators demonstrate how modest, regular contributions can compound into meaningful support for education or marriage.

Success stories: real impact translated from numbers

Case stories from across India — families who started with modest deposits and saw substantial maturity amounts two decades later — make the SSY narrative concrete. Financial literacy programs have showcased examples where disciplined use of a Sukanya Samriddhi Yojana Interest Calculator clarified how much to save annually to meet a specific education target. Government releases point to millions of accounts opened and sizeable aggregate deposits, underscoring the scheme’s societal reach. These success stories are testimony to both the scheme’s design and the efficacy of planning tools like the Sukanya Samriddhi Yojana Interest Calculator. Press Information Bureau

Common pitfalls and challenges in using a Sukanya Samriddhi Yojana Interest Calculator

While the Sukanya Samriddhi Yojana Interest Calculator is straightforward, several practical issues can confuse planners:

- Wrong interest rate inputs: Because the government revises the SSY rate quarterly, using an outdated rate will yield misleading projected corpus values. Always confirm the current quarter’s rate before running the calculator. India Bonds

- Ignoring deposit limits or timing: Calculators are accurate only when you input the correct deposit timing. Depositing late in a financial year or skipping a contribution year changes maturity outcomes.

- Assuming monthly compounding: SSY compounds annually. If a calculator assumes monthly compounding (as some generic compound interest calculators do), results will be slightly off.

- Tax misinterpretation: Since SSY is EEE, the interest earned and maturity amount are tax-free. But misuse of tax terms or misunderstanding the Section 80C ceiling can lead to improper tax benefit expectations. HDFC Bank

Being aware of these pitfalls helps you use a Sukanya Samriddhi Yojana Interest Calculator accurately and meaningfully.

SSY versus other savings schemes: how the Sukanya Samriddhi Yojana Interest Calculator helps comparison

Comparing SSY with alternatives (PPF, NSC, fixed deposits, or child-education mutual funds) is easier when you can model outcomes. Here’s how SSY typically stacks up, and how a Sukanya Samriddhi Yojana Interest Calculator clarifies the choice:

- SSY vs PPF: Both are government-backed and tax-efficient. SSY typically offers a rate competitive with PPF but with the social objective of girl-child corpus building. PPF allows longer contribution flexibility (15 years deposit window and up to 15 more years extension options) and is not restricted by beneficiary age. A Sukanya Samriddhi Yojana Interest Calculator will show comparable or higher final corpus if SSY’s current rate is above the PPF rate. Groww

- SSY vs Fixed Deposits: Fixed deposits may offer higher short-term rates but are taxable. When adjusted for taxes, the guaranteed, tax-free return on SSY often becomes more attractive for long-term needs like education.

- SSY vs Mutual Funds / SIPs: Equity SIPs can offer higher long-term potential but come with volatility. SSY’s government guarantee and EEE treatment make it attractive for risk-averse parents. A Sukanya Samriddhi Yojana Interest Calculator shows deterministic outcomes; mutual fund projections require assumptions about equity returns and are inherently probabilistic.

Using a Sukanya Samriddhi Yojana Interest Calculator is the first step in an apples-to-apples comparison across instruments, because it fixes the SSY outcomes and lets you benchmark alternatives.

Policy framework and social context: why SSY is significant

Sukanya Samriddhi Yojana fits within a broader policy architecture focusing on women’s empowerment and targeted social investment. Beyond financial returns, SSY serves social objectives:

- Encouraging girl-child education: By creating a ring-fenced corpus for a girl’s future, the scheme aims to reduce economic reasons for early marriage or school dropouts.

- Promoting financial inclusion: With account access through post offices and banks, SSY nudges families into the formal financial system.

- Linking welfare to gender outcomes: States and local agencies sometimes complement beneficiary families’ savings with matching or lump-sum transfers, amplifying the scheme’s effect.

A Sukanya Samriddhi Yojana Interest Calculator therefore is not just a numeracy tool; it translates policy intent into personal financial outcomes that families can visualize.

How financial institutions and online calculators differ

Banks and financial portals provide Sukanya Samriddhi Yojana Interest Calculators with clean interfaces and prefilled rates. Differences between calculators include:

- Rate update frequency: Official bank calculators typically update rates each quarter; independent portals may lag.

- Input flexibility: Some calculators allow month-wise deposits, others only annual contributions.

- Additional features: Advanced calculators show IRR (internal rate of return), break-up of interest versus principal, and partial withdrawal projections.

When using a Sukanya Samriddhi Yojana Interest Calculator, prefer tools from reputable banks or well-known financial platforms and double-check the rate source.

Adjusting projections for life events: portability and withdrawal rules

SSY accounts are portable — if you move states or change banks, the account can be transferred, which is important for migrant families. Partial withdrawal rules allow up to 50% withdrawal for higher education expenses once the girl turns 18. The remainder continues to earn interest until maturity. A sophisticated Sukanya Samriddhi Yojana Interest Calculator includes scenarios for partial withdrawals at 18 and recalculates the remaining corpus at maturity, making it easier to align the savings plan with real educational expenses. Indian Bank

Designing a contribution strategy with a Sukanya Samriddhi Yojana Interest Calculator

Financial planners commonly use the Sukanya Samriddhi Yojana Interest Calculator to craft contribution strategies:

- Backwards planning: Identify the target corpus needed at maturity for education and reverse-engineer the annual deposit using the calculator.

- Front-loading: If you have a lump sum early on, front-loading deposits (subject to maximum annual limit) can boost corpus significantly due to compounding.

- Incremental increases: Many parents start with modest deposits and increase contributions as income rises; the calculator helps model such stepped contributions.

- Hybrid approach: Combine SSY with other long-term investments to balance security and growth, using the Sukanya Samriddhi Yojana Interest Calculator to lock in the guaranteed portion.

These strategies benefit from certainty: SSY offers guaranteed rates and tax exemption, and the calculator makes those guarantees actionable.

Digital literacy and accessibility: spreading the Sukanya Samriddhi Yojana Interest Calculator

Financial literacy programs often adopt the Sukanya Samriddhi Yojana Interest Calculator as a teaching tool. Workshops show parents how even small monthly contributions equate to substantial outcomes at maturity. Because many calculators are mobile-friendly, even households in remote areas can visualize the benefits. Government portals, post offices, and bank branches often provide printed brochures and calculator links as part of outreach.

Monitoring the scheme: what to watch for each quarter

Because the SSY rate is updated quarterly, any investor using a Sukanya Samriddhi Yojana Interest Calculator should watch:

- Official notifications: Government releases and the National Small Savings portal publish official rates. Use those rates for accurate calculations. NSI India+1

- Macro triggers: Bond yields, RBI policy changes, and fiscal considerations can influence the rate reviews.

- Media coverage: Financial media often summarize the quarterly rates and provide comparison analyses.

Keeping your Sukanya Samriddhi Yojana Interest Calculator tuned to the latest official rate ensures continued accuracy.

Challenges and critiques: where the scheme and calculators may fall short

While SSY is broadly successful, critiques exist:

- Rate vulnerability: Being linked to small-savings policy, the SSY rate can fall during periods of low bond yields, reducing future yield expectations. News reports in some quarters discuss potential rate adjustments tied to macro conditions. The Economic Times

- Liquidity constraints: The account locks funds for long periods; while partial withdrawals are allowed from age 18 for education, early liquidity is limited.

- Administrative delays: At times, account transfers or updates may involve paperwork and delays, which can affect account maintenance and timely deposits.

A Sukanya Samriddhi Yojana Interest Calculator cannot resolve policy or administrative issues, but it helps households plan within those constraints.

Future prospects: what’s next for the Sukanya Samriddhi Yojana and its calculators

Looking ahead, potential areas of evolution include:

- Greater digital onboarding: While SSY has usually required physical account opening at post offices or banks, there is scope for more digital processes (subject to policy and procedural changes).

- Integration with welfare disbursements: States may increasingly use SSY accounts as a vehicle for targeted transfers to girls, leveraging the scheme’s tax and safeguarding benefits.

- Enhanced calculators: We can expect calculators that integrate inflation-indexed education cost projections, tax implications, and portfolio mix suggestions, making the Sukanya Samriddhi Yojana Interest Calculator a more holistic planning tool.

Each step forward will improve how families forecast and secure a girl child’s financial future.

Choosing the right Sukanya Samriddhi Yojana Interest Calculator — checklist

When selecting an online Sukanya Samriddhi Yojana Interest Calculator, ensure:

- The calculator uses the latest government-notified SSY rate. India Bonds

- It allows entry of custom year-wise contribution patterns.

- It outputs total contributions, total interest, and maturity corpus.

- It models partial withdrawal at 18 and the remaining maturity value.

- It is hosted by a reputable institution (a bank, recognized financial portal, or government site). HDFC Bank+1

A good Sukanya Samriddhi Yojana Interest Calculator clarifies choices and reduces guesswork.

Practical tips for parents and guardians

- Start early: Earlier account opening gives more compounding years. A Sukanya Samriddhi Yojana Interest Calculator will show the dramatic difference early starts make.

- Aim for consistency: Regular deposits, even modest ones, add up. Use the calculator to set a realistic annual contribution target aligned with household budgets.

- Use tax benefit smartly: Leverage Section 80C deductions but keep the overall annual tax planning in mind. HDFC Bank

- Keep documentation ready: Birth certificate proof and guardian ID are required at account opening; maintain records for easy compliance.

- Validate rates: Before finalizing plans, verify the quarter’s official SSY rate and rerun the Sukanya Samriddhi Yojana Interest Calculator.

FAQs — Sukanya Samriddhi Yojana Interest Calculator

Conclusion: Use the Sukanya Samriddhi Yojana Interest Calculator to make certainty your ally

Sukanya Samriddhi Yojana combines a social objective with a simple, guaranteed financial product. The Sukanya Samriddhi Yojana Interest Calculator is the indispensable companion that translates policy rules into personal action: how much to save, when to save, and what corpus to expect. By starting early, validating the current government rate, and using a calculator from a trusted source, parents and guardians can craft a disciplined plan that harnesses the power of compounding and tax efficiency. Whether you are balancing household cash flows, planning education expenses, or ensuring financial dignity for your daughter, the numbers from a Sukanya Samriddhi Yojana Interest Calculator will keep your goals realistic, measurable, and achievable.

Sources and further reading: Official scheme descriptions and operational rules are published on the National Small Savings/India Post portals and government releases. For quarterly rate notifications and policy context, consult government releases and mainstream financial coverage. Key references used while compiling this guide include the National Small Savings information pages, government PIB summaries, and financial portals that host SSY calculators and rate updates. HDFC Bank+4NSI India+4Press Information Bureau+4

bg