Sukanya Samriddhi Yojana Maturity Calculator

Plan your daughter’s future with the SSY scheme

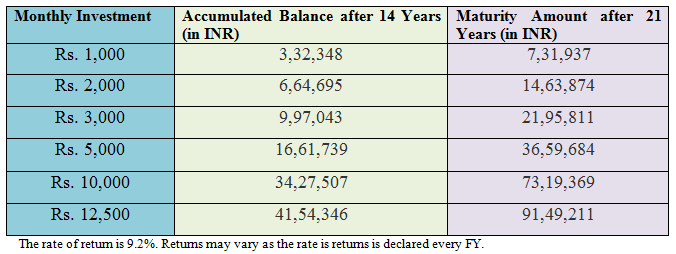

Projected Investment Returns

Sukanya Samriddhi Yojana Maturity Calculator is more than a digitized tool; it is an enabler that helps parents, guardians, and policymakers project future financial outcomes for the girl child under one of India’s flagship girl-child savings schemes. This long-form, in-depth guide explains the origin, objectives, mechanics, state-level effects, implementation challenges, success stories, comparisons with alternative instruments, and future prospects of the scheme — and shows how the Sukanya Samriddhi Yojana Maturity Calculator fits into the broader mission of women’s empowerment, rural development, and social welfare.

Introduction: why the Sukanya Samriddhi Yojana Maturity Calculator matters

Governments design social financial instruments to nudge savings behavior and secure future needs. The Sukanya Samriddhi Yojana (SSY) was launched with a clear mission to secure the financial future of girls, encouraging families to save early and consistently for education and marriage expenses. A Sukanya Samriddhi Yojana Maturity Calculator bridges the gap between intention and informed planning — it allows families to translate periodic contributions and interest assumptions into a projected maturity corpus.

For many families, financial planning is an intimidating and technical exercise. The Sukanya Samriddhi Yojana Maturity Calculator reduces that friction by turning variables — deposit amount, deposit frequency, tenure left, and current interest rates — into a comprehensible maturity figure. For policymakers and state-level program managers, aggregate outputs from such calculators inform outreach strategies, subsidy calibrations, and the assessment of regional uptake patterns.

Origins and historical context of Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana was launched in 2015 as part of the broader “Beti Bachao, Beti Padhao” (Save the Daughter, Educate the Daughter) initiative. The scheme targets parents or legal guardians of girls below a prescribed age, offering a tax-advantaged savings route with relatively high interest rates compared to basic savings accounts or some fixed deposits. Its design is intentionally simple: regular contributions over a limited deposit window produce a locked-in corpus that matures when the girl reaches adulthood.

The Sukanya Samriddhi Yojana Maturity Calculator emerged as an essential complement to the product — first as manual tables and simplified worksheets and then as web-based calculators hosted by banks, post offices, and third-party financial-education platforms. As awareness expanded and mobile internet penetration increased, these calculators became indispensable tools for households wanting transparent projections and for NGOs and government agencies designing targeted communications.

Objectives and core features of the scheme

The Sukanya Samriddhi Yojana aims to:

- Encourage long-term savings for a girl’s education and marriage.

- Provide a secure, government-backed instrument with attractive interest.

- Offer tax benefits to contributors under existing tax rules.

- Reduce financial dependency and promote women’s agency through financial readiness.

Core features include: account opening eligibility for girls below a specified age, a defined deposit period (generally 15 years from account opening), a lock-in until maturity (typically when the beneficiary turns 21, with partial withdrawals for higher education allowed earlier), and government-set interest rates that are periodically revised. The Sukanya Samriddhi Yojana Maturity Calculator is designed to accept these features as variables and estimate a future corpus, helping families choose suitable deposit amounts and frequencies.

How the Sukanya Samriddhi Yojana Maturity Calculator works

At its simplest, a Sukanya Samriddhi Yojana Maturity Calculator takes three classes of inputs: contribution schedule, interest rate, and duration until maturity. Calculators may accept lump-sum deposits, monthly contributions, or annual deposits. They usually compound interest annually or as per scheme rules. The calculations mirror the scheme’s statutory formulas and often include fields to accommodate rate changes or early partial withdrawals.

A generic calculation procedure includes:

- Inputting the girl’s current age or years until maturity.

- Choosing deposit frequency and amount (monthly/annually or ad hoc lumps).

- Specifying the current interest rate (defaulting to the published rate).

- Running the calculation to produce the total contributions, accrued interest, and maturity value.

Advanced Sukanya Samriddhi Yojana Maturity Calculator tools may include sensitivity analyses (showing how maturity changes if rates rise or fall), scenario comparisons (monthly versus annual deposit), and tax-adjusted projections. For many users, seeing a side-by-side comparison between the maturity amounts under different interest scenarios is crucial for resilient planning.

The legal and operational framework

The Sukanya Samriddhi Yojana is governed by a central policy framework and implemented through a network of state-owned banks and post offices. The central government sets eligibility, interest rate methodology, withdrawal rules, and maturity conditions. Financial institutions serve as primary points of service; they accept deposits, maintain records, and disburse maturities. A Sukanya Samriddhi Yojana Maturity Calculator therefore needs to adhere to these rules — for example, accounting for the prescribed 15-year deposit window and for the lock-in until a specified age.

Operational responsibilities are distributed: the Center defines the scheme and rates; public-sector and authorized private institutions manage customer-facing operations; state governments and local bodies support awareness and accessibility. This layered model has helped scale the Sukanya Samriddhi Yojana into both urban and rural ecosystems.

State-level impact and regional nuances

State-by-state adoption of the scheme varies widely, influenced by demographic patterns, literacy levels, financial inclusion, and program outreach. The Sukanya Samriddhi Yojana Maturity Calculator becomes particularly useful in states with lower financial literacy because it demystifies expected returns and communicates the long-term value of early saving.

In more urbanized states, higher-income groups might opt for diversified instruments, using the Sukanya Samriddhi Yojana to complement other savings. In contrast, in states with strong public-sector outreach and active civil society campaigns, the scheme is more likely to be utilized by low- and middle-income households seeking assured returns and tax benefits. The presence of post offices and localized banking infrastructure also affects penetration — where post offices remain a trusted interface, uptake is greater.

Regional differences also shape demand for certain calculator features. For instance, states with higher migration might favor calculators that project maturity in foreign currency equivalents or show portability features. States with higher schooling costs may need tools that allow users to simulate staggered withdrawals for higher education.

Success stories: measurable outcomes and human narratives

Across diverse districts, the Sukanya Samriddhi Yojana has provided families with a secure way to prepare financially for girls’ futures. Micro-narratives often highlight parents who started small monthly deposits and by maturity were able to fund higher education, reducing dependence on loans. Community organizations in rural pockets leveraged the Sukanya Samriddhi Yojana Maturity Calculator in group workshops to show mothers how consistent small deposits compound — turning abstract benefits into concrete numbers.

At an institutional level, certain districts reported a jump in female school enrolment and a reduction in early marriages where the scheme was bundled with complementary interventions (awareness camps, school-linked banking drives). These outcomes underline the importance of coupling financial products with social campaigns. The Sukanya Samriddhi Yojana Maturity Calculator plays a role in these success stories by creating transparent expectations and motivating disciplined saving behavior.

Challenges in implementation and awareness

No social financial instrument scales without encountering operational and socio-cultural challenges. Key hurdles for the Sukanya Samriddhi Yojana include:

- Awareness gaps: Many eligible families remain unaware of the scheme’s features and benefits. Misconceptions about lock-in rules or eligibility deter participation.

- Financial literacy: Complexities around compounding interest and tax benefits often discourage engagement. While a Sukanya Samriddhi Yojana Maturity Calculator helps, reaching the digitally unconnected remains a challenge.

- Administrative friction: Paper-based KYC and account opening procedures in some areas increase transactional costs and reduce convenience.

- Interest rate volatility: As the government revises interest rates periodically, unpredictable changes can complicate forward planning. Users relying on a static Sukanya Samriddhi Yojana Maturity Calculator may need to adjust for potential rate shifts.

- Cultural barriers: Gender norms and preferences sometimes deprioritize saving for girls. In such contexts, outreach and community-level persuasion are essential.

Addressing these issues requires a blend of technology, policy choices, and community engagement. The calculator alone cannot correct structural deficits but acts as a vital tool when combined with tailored awareness drives and simplified procedures.

Comparing Sukanya Samriddhi Yojana with other savings instruments

For parents weighing options, understanding how the Sukanya Samriddhi Yojana stacks up against alternatives — like public provident fund (PPF), fixed deposits, recurring deposits, and child education plans — is critical. Key comparative points include:

- Return profile: Typically, the Sukanya Samriddhi Yojana offers higher interest than many traditional savings accounts and is often competitive with PPF, though rates are set separately and can change.

- Tax benefits: SSY contributions and interest often enjoy tax treatment under relevant sections of tax law, making it an EEE (exempt-exempt-exempt) style instrument in some regimes — but exact tax implications must be checked against current law.

- Liquidity: SSY has a lock-in till maturity with limited early withdrawal provisions, making it less liquid than recurring deposits or many child education insurance plans.

- Risk: Being government-backed, SSY carries low default risk compared with market-linked instruments.

- Purpose-specific design: Unlike generic PPF or FDs, SSY is explicitly designed for the girl child, with rules tailored for education and marriage expenses.

A Sukanya Samriddhi Yojana Maturity Calculator therefore acts as a decision aid — not only showing expected returns but enabling side-by-side comparisons with these alternatives, which helps families choose the instrument that matches liquidity needs, risk tolerance, and tax strategies.

Using the Sukanya Samriddhi Yojana Maturity Calculator for practical planning

A well-designed Sukanya Samriddhi Yojana Maturity Calculator helps parents make several practical decisions:

- Target corpus planning: By entering the expected future cost of education or marriage (inflation-adjusted), users can compute the monthly or annual savings required.

- Sensitivity testing: Users can vary interest rates and deposit amounts to see how small increases in saving frequency improve outcomes.

- Tax planning alignment: When coupled with tax calculators, SSY projections help integrate scheme planning into broader tax-efficient investment plans.

- Intergenerational planning: For families contributing across siblings and generations, the calculator can produce a consolidated view of expected liabilities and expected returns.

When used properly, the Sukanya Samriddhi Yojana Maturity Calculator clarifies trade-offs: whether to prioritize higher monthly contributions now or keep modest contributions and seek complementary financing later.

Design and UX considerations for effective calculators

To maximize utility and adoption, Sukanya Samriddhi Yojana Maturity Calculator tools should prioritize clarity and trust. Best practices include:

- Simple input fields: Age, contribution frequency, and amount are essential; optional fields for rate change scenarios enrich utility without clutter.

- Transparent assumptions: Clearly state compounding frequency, the assumed interest rate, and tax treatment so users can interpret outputs correctly.

- Local language support: Because many users are more comfortable in regional languages, multi-language interfaces increase accessibility.

- Mobile-first design: Many households primarily access the internet through smartphones; responsive interfaces and lightweight pages encourage use.

- Offline aids: Printable worksheets or SMS-based calculators help those without regular internet.

- Educational modules: Short explainer text, mini-videos, and contextual examples help users grasp compounding and tax nuances.

These features improve uptake and ensure that families do not misinterpret projected outcomes. A Sukanya Samriddhi Yojana Maturity Calculator must be more than accurate — it must be comprehensible.

Fiscal and macro implications

While the scheme primarily serves households, it has implications for public finances and macroeconomic patterns. Government-backed savings channels like SSY mobilize household savings into safe instruments, affecting domestic savings rates and investment patterns. For government budgets, interest payouts on such instruments are an explicit liability; hence, rate-setting balances affordability for the exchequer with attractiveness for savers.

The Sukanya Samriddhi Yojana Maturity Calculator can be useful at a macro level: aggregated projections across accounts allow planners to estimate future payout obligations and plan fiscal buffers. Furthermore, regional adoption data derived from calculator usage can guide targeted financial inclusion investments, optimizing resource allocation across states.

Integration with complementary initiatives

The Sukanya Samriddhi Yojana works best when integrated with complementary schemes. Education subsidies, scholarship programs, conditional cash transfers, and school-based financial literacy programs multiply the scheme’s effectiveness. For example, in districts where school-linked SSY enrollment camps were held, conversion rates and sustained deposits were higher.

A Sukanya Samriddhi Yojana Maturity Calculator that integrates with school records or scholarship portals can anticipate funding gaps and trigger counselling alerts for guardians when top-ups are needed. Integration with digital identity systems and mobile banking reduces friction in account opening and verification, widening access.

Future prospects and potential reforms

Looking ahead, several reforms could enhance the scheme’s reach and impact:

- Automated contribution features: Direct debit or micro-savings options could transform erratic deposits into disciplined saving.

- Indexation options for interest: Linking interest to inflation or GDP growth rates would make returns more predictable in real terms.

- Tiered benefits: Additional incentives for continued education or delayed marriage could reinforce social objectives.

- Greater portability: Simplifying transfers across financial institutions and states would strengthen user convenience.

- Data-driven outreach: Aggregate Sukanya Samriddhi Yojana Maturity Calculator usage metrics can pinpoint underserved areas and tailor campaigns.

Policy discussions are likely to balance these enhancements with fiscal considerations. Any change in rate-setting mechanisms or tax treatment would necessitate corresponding updates to Sukanya Samriddhi Yojana Maturity Calculator logic, underscoring the need for agile digital tools.

Case study: community-driven adoption and the role of the calculator

Consider a hypothetical rural block where an NGO, local health workers, and a postal bank collaborated to promote girl-child education. Workshops used a Sukanya Samriddhi Yojana Maturity Calculator projected in the local language on a tablet. Participants entered modest monthly sums and watched the maturity figure grow visually. This tangibility reduced skepticism and led to a spike in account openings. Over a decade, several families used the matured corpus for secondary and tertiary education, and local schools reported better retention rates for girls.

This case reflects the broader truth: numbers matter. The Sukanya Samriddhi Yojana Maturity Calculator gave participants both a goal and a measurable pathway, turning abstract social objectives into individualized financial plans.

Ethical, gender, and social considerations

Financial instruments do not exist in a vacuum. Gendered norms, intra-household dynamics, and cultural expectations influence whether savings for girls are prioritized. The Sukanya Samriddhi Yojana and its maturity calculators must therefore be deployed sensitively.

Transparent calculators help avoid exploitation or mis-selling, but they are not a replacement for community dialogues. Programs must ensure that the existence of a Sukanya Samriddhi Yojana account does not substitute for deeper structural interventions like improving girls’ access to quality schooling or addressing gender-based violence. The maturity calculator is a planning tool — a powerful one — but it must operate within a rights-based, gender-sensitive approach.

Practical tips for families using the Sukanya Samriddhi Yojana Maturity Calculator

When engaging with a Sukanya Samriddhi Yojana Maturity Calculator, consider the following practical suggestions:

- Treat the calculator’s output as a projection, not a promise. Interest rates can change; program rules can be updated.

- Use scenario planning: simulate conservative, moderate, and optimistic interest-rate environments.

- Consider inflation: ensure that the target corpus reflects expected future costs in real terms.

- Combine instruments: SSY is safe and tax-efficient, but families may also need complementary instruments for liquidity or higher-growth needs.

- Keep records: if accounts are opened through post offices or banks, maintain periodic statements to track deposits and interest accrual.

These behaviors make the calculator more actionable and ensure that families convert projections into real financial preparedness.

Measuring impact: monitoring and evaluation frameworks

To gauge the scheme’s success and refine outreach strategies, governments and civil society rely on monitoring and evaluation frameworks. Key indicators include account openings, average deposit size, continuity of contributions, use of maturity proceeds for education versus marriage, and differential uptake across socio-economic groups.

A Sukanya Samriddhi Yojana Maturity Calculator integrated with backend analytics can generate anonymized, aggregate insights. For instance, spikes in predicted maturity shortfalls in particular districts might trigger targeted top-up drives or scholarship interventions.

Common misconceptions about the scheme and calculator

Several misconceptions persist:

- “The corpus is easily accessible anytime.” The scheme has specific withdrawal rules; early access is restricted and often allowed only for higher education needs with documentation.

- “Interest rates are fixed forever.” Rates are periodically revised by authorities; calculators should allow for rate variability.

- “It is only for wealthy families.” The scheme’s low minimum deposit makes it accessible even to low-income households; small but regular saving yields substantial long-term gains.

- “Calculators predict exact future values.” Calculators provide projections based on inputs and assumptions; real-world outcomes may differ due to rate changes, missed contributions, or policy revisions.

Clearing these misconceptions is essential for increasing trust and participation.

Technological innovations shaping the future of maturity calculators

Emerging technologies promise to make Sukanya Samriddhi Yojana Maturity Calculator tools smarter and more inclusive:

- AI-driven personalization: Adaptive interfaces that recommend deposit patterns based on income cycles (e.g., seasonal incomes for agricultural households).

- Chatbot integrations: Conversational calculators that guide users step-by-step in local languages.

- API ecosystems: Integration with school portals, scholarship databases, and mobile wallets to streamline contributions and automate reminders.

- Offline-first apps: Tools that sync when connectivity is available, enabling use in low-bandwidth regions.

As tools evolve, ensuring data privacy and secure authentication remains paramount.

Conclusion: the Sukanya Samriddhi Yojana Maturity Calculator as an empowerment tool

The Sukanya Samriddhi Yojana Maturity Calculator is far more than a spreadsheet; it is an instrument of foresight. By translating long-term financial policy into accessible, personalized projections, the calculator empowers guardians to plan with clarity, supports policymakers in targeting interventions, and strengthens the social objective of preparing girls for independent, dignified futures. When combined with sustained outreach, simplification of administrative procedures, and complementary social services, the Sukanya Samriddhi Yojana and its associated maturity calculators can play a transformative role in advancing women’s empowerment, improving educational access, and catalyzing inclusive rural development.