Sukanya Samriddhi Yojana Return Calculator

Plan your daughter’s future with the SSY scheme

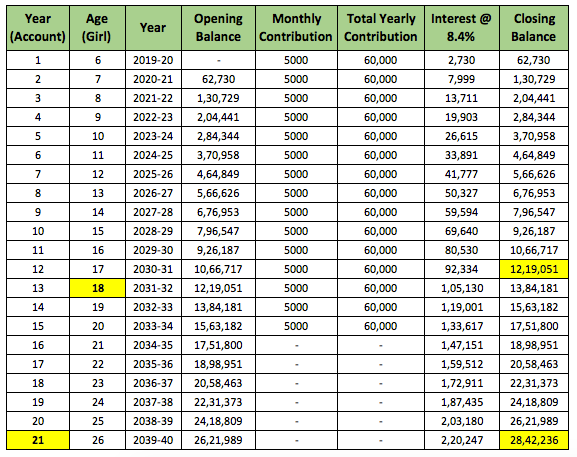

Projected Investment Returns

The Sukanya Samriddhi Yojana return calculator has become an indispensable tool for parents and guardians trying to plan long-term savings for a girl child in India. As one of the flagship schemes under the “Beti Bachao, Beti Padhao” initiative, Sukanya Samriddhi Yojana (SSY) combines tax benefits, guaranteed returns, and disciplined savings to create a corpus for education and marriage expenses. This article explains, in depth, how the sukanya samriddhi yojana return calculator works, why it matters, and how to interpret its outputs to make sound, state-wise, and real-world financial choices.

Understanding Sukanya Samriddhi Yojana: Origins and Objectives

Sukanya Samriddhi Yojana was launched in 2015 by the Government of India to encourage parents to save for a girl child’s future. The primary objectives were simple but powerful: promote the welfare of the girl child, ensure financial security for education and marriage, and incentivize savings through attractive interest rates and tax benefits.

At its core, SSY is a small-deposit, long-term saving instrument targeted at families with girl children. Contributions can be made for 15 years from account opening, and the account matures 21 years after opening or upon marriage after the child turns 18. The scheme’s guaranteed interest rates and tax benefits under Section 80C make it particularly appealing when modeled using a sukanya samriddhi yojana return calculator.

How the Sukanya Samriddhi Yojana Return Calculator Works

A sukanya samriddhi yojana return calculator is a financial tool designed to estimate the maturity amount and interest earnings of an SSY account based on inputs such as initial deposit, monthly or yearly contribution, interest rate, tenure, and deposit frequency. The calculator uses the compounding interest formula applicable to the scheme and provides projections that help in planning.

Typical inputs for a sukanya samriddhi yojana return calculator include:

- Initial deposit amount (minimum and maximum limits as per current rules)

- Periodic contribution amount (yearly or lump-sum)

- Interest rate (the scheme’s notified rate; variable and subject to quarterly revision)

- Number of years contributions will be made (up to 15 years)

- Expected tenure until maturity (21 years from account opening)

The output gives an estimate of the maturity corpus, total contributions made, and interest earned. Using the sukanya samriddhi yojana return calculator empowers parents to set realistic savings targets and check the adequacy of their current investment plan.

Why Use a Sukanya Samriddhi Yojana Return Calculator?

Relying on rules-of-thumb or manual calculations can lead to under- or over-estimation of future needs. The sukanya samriddhi yojana return calculator helps in several concrete ways:

- Precision: It takes into account compounding and periodic deposits.

- Scenario planning: Users can test “what-if” scenarios—what if interest rates change, or if contributions are increased?

- Comparison: It allows side-by-side comparisons with other deposit products like PPF, fixed deposits, or National Savings Certificates.

- Goal alignment: It helps align contributions with education and marriage cost projections.

- Tax planning: By reflecting tax benefits under Section 80C, the calculator assists in overall tax-efficient planning.

When parents plug numbers into a sukanya samriddhi yojana return calculator, they gain a better idea of how much to contribute each year to meet future goals.

Mechanics of Interest Calculation: What the Calculator Assumes

SSY interest is compounded annually, and the sukanya samriddhi yojana return calculator typically uses the notified annual rate to compute matured value. The formula employed by most calculators approximates yearly compounding:

Maturity Amount = Sum of [(Contribution in year t) × (1 + r)^(n − t + 1)]

Here, ‘r’ is the annual interest rate, ‘n’ is the total years to maturity, and ‘t’ indexes the year of each deposit. Calculators may vary in how they handle partial-year deposits or mid-year changes in contribution frequency, so it’s important to use a reliable, up-to-date sukanya samriddhi yojana return calculator that lets you specify deposit patterns and the interest rate expected over each period.

Recent Interest Rate Trends and Their Impact

Sukanya Samriddhi Yojana interest rates are reviewed quarterly by the Government of India. While historically SSY has offered rates higher than many traditional fixed-income instruments, these rates fluctuate with broader macroeconomic policies and inflationary trends. Because the maturity corpus is sensitive to the interest rate, periodic recalibration using a sukanya samriddhi yojana return calculator is crucial.

A practical approach is to run multiple scenarios in the sukanya samriddhi yojana return calculator—one with the current rate, one slightly conservative (lower), and one optimistic—to understand the range of possible outcomes. This helps safeguard against complacency in financial planning and allows contingency buffers to be built into annual contributions.

Eligibility and Account Rules: Inputs for Your Calculator

Before using a sukanya samriddhi yojana return calculator, ensure eligibility and understand rules governing deposits and withdrawals:

- Eligibility: A girl child up to 10 years of age is eligible for opening an SSY account. Parents or legal guardians can open the account in the name of the girl child.

- Deposit Window: Deposits are allowed for 15 years from the date of account opening.

- Minimum and Maximum Deposits: The minimum yearly deposit is set (historically it’s been ₹250), while the maximum deposit per financial year has limits (this has varied; check the latest guidelines).

- Partial Withdrawals: Partial withdrawal is permitted after the girl reaches 18 years for higher education or marriage up to 50% of the balance at the end of the preceding financial year.

- Premature Closure: Premature closure is allowed under certain circumstances such as the death of the account holder or if the government permits; traditional premature withdrawals are restricted.

- Tax Benefits: Contributions qualify for deductions under Section 80C, interest is tax-free, and the maturity amount is exempt—making SSY an EEE (exempt-exempt-exempt) instrument, and adding to the returning value modeled in your sukanya samriddhi yojana return calculator.

Inputting the correct deposit behavior and tenure into your sukanya samriddhi yojana return calculator will yield accurate projections.

How to Interpret Calculator Outputs

A typical sukanya samriddhi yojana return calculator produces several outputs:

- Total Contributions: Sum of all deposits made across the deposit years.

- Total Interest Earned: Total accrued interest over the tenure.

- Maturity Amount: Final corpus available at the end of the scheme’s maturity period.

- Year-wise Schedule: Many calculators also provide a year-by-year balance schedule showing contributions, interest, and cumulative balance—a powerful visualization to track progress.

When interpreting these outputs, focus on the maturity amount relative to your projected cost of higher education or marriage. If there is a shortfall, the sukanya samriddhi yojana return calculator can help you determine additional monthly or annual contributions needed to bridge the gap.

State-Level Considerations: Why Geography Matters

Although the scheme is central and uniformly administrated across India, state-level factors influence both the desirability and practical use of SSY:

- Regional Cost of Education: In metro cities where education costs are higher, the corpus calculated by a sukanya samriddhi yojana return calculator may need to be supplemented with other investments.

- State Schemes Complementarity: Some states run supplementary girl-child welfare schemes—scholarships, incentives for school attendance, or conditional cash transfers—that interact with SSY benefits. Parents should factor in these when using a sukanya samriddhi yojana return calculator to estimate net requirements.

- Bank/Post Office Access: In remote and rural areas, post offices often serve as primary SSY account touchpoints. Interest credited and compounding happen uniformly, but access to online calculators or digital deposit options may vary by state and region.

- Financial Literacy and Outreach: States with stronger outreach programs might see higher uptake of SSY and better usage of the sukanya samriddhi yojana return calculator among beneficiaries.

Thus, while the sukanya samriddhi yojana return calculator uses uniform math, the reality on the ground—cost of living, state-level support, and access—affects planning.

Case Studies and Success Stories

Concrete examples help translate the numbers from a sukanya samriddhi yojana return calculator into real life. Consider a few prototypical cases:

- Urban Working Parents: A couple in Bangalore uses a sukanya samriddhi yojana return calculator to plan ₹5,000 annual deposits for 15 years. The calculator projects a corpus sufficient to cover a significant portion of undergraduate education if current interest rates persist. Combined with a systematic investment plan (SIP) in equity funds for inflation-beating growth, SSY serves as a low-risk anchor.

- Rural Households: A rural mother in Uttar Pradesh opens an SSY account at a local post office with modest yearly deposits. The sukanya samriddhi yojana return calculator projects steady compound growth; when paired with state scholarships, the family can finance secondary education.

- Single-Parent Guardians: Guardians often rely on the sukanya samriddhi yojana return calculator to set conservative targets ensuring a guaranteed corpus irrespective of market volatility.

These success stories illustrate how disciplined contributions—guided by a sukanya samriddhi yojana return calculator—turn small sums into sizable funds for a girl child’s future.

Comparing SSY to Other Schemes: Use the Calculator to Decide

Comparison is where the sukanya samriddhi yojana return calculator shines. Comparing SSY against PPF, fixed deposits, or equity investments requires evaluating returns, tax treatment, liquidity, and risk.

- Public Provident Fund (PPF): Both PPF and SSY offer government-backed, tax-free returns, but PPF allows contributions up to 15 years with a longer maturity. Use a sukanya samriddhi yojana return calculator to compare the same annual deposit across SSY and PPF to decide based on tenure and liquidity.

- Fixed Deposits (FDs): FDs provide fixed returns but taxable interest reduces post-tax yield. An FD vs SSY comparison using a sukanya samriddhi yojana return calculator reveals the tax advantage of SSY.

- Mutual Funds/Equity: Equity investments may outpace SSY returns but come with volatility. The sukanya samriddhi yojana return calculator can be one leg of a diversified plan—offering guaranteed portion while equities aim for higher growth.

- Child-Specific Endowment Plans: Insurance-linked plans may offer combined cover and savings but often have higher fees. Modeling these alternatives alongside SSY using a sukanya samriddhi yojana return calculator clarifies the trade-offs.

The sukanya samriddhi yojana return calculator, in short, is not just about SSY—it’s a decision-making tool for optimal allocation among instruments.

Behavioral Finance: How the Calculator Encourages Discipline

Financial discipline is often the biggest challenge in long-term planning. The sukanya samriddhi yojana return calculator indirectly promotes discipline by making future outcomes visible. When parents see the projected shortfall or the benefit of small incremental increases in contributions, they are more likely to stick to a plan. Visualizing the maturity schedule reinforces commitment and reduces the temptation to divert funds.

Moreover, the tax advantages highlighted by the sukanya samriddhi yojana return calculator further motivate consistent deposits, since the dual benefit of tax deduction and guaranteed interest is compelling.

Practical Tips for Maximizing Returns

To get the most out of SSY—and from the projections of a sukanya samriddhi yojana return calculator—consider these practical tips:

- Start Early: Earlier deposits compound longer. Even small early contributions show significant differences in a sukanya samriddhi yojana return calculator.

- Use Lump Sum Top-Ups When Possible: If a windfall arrives, adding a lump sum increases the compound base.

- Maximize Yearly Contributions Within Limits: If cash flow permits, moving toward the upper allowable limit increases the maturity corpus substantially.

- Review Annually: Interest rates change. Re-run your sukanya samriddhi yojana return calculator annually to track progress.

- Leverage Partial Withdrawals Wisely: Partial withdrawal is allowed post-18 for education—plan withdrawals to avoid compromising the corpus needed for later milestones.

These steps, guided by regular use of a sukanya samriddhi yojana return calculator, improve the probability of meeting goals.

Challenges and Criticisms

While SSY is widely praised, it has limitations and faces criticisms that a realistic sukanya samriddhi yojana return calculator can surface:

- Interest Rate Sensitivity: Because rates are variable, the maturity corpus can shrink relative to initial projections if rates decline.

- Contribution Cap: The annual maximum cap may be insufficient for families with higher expected educational expenses.

- Liquidity Constraints: Long lock-in till maturity reduces flexibility—though partial withdrawals mitigate this to an extent.

- Inflation Risk: Guaranteed nominal returns may not keep pace with education cost inflation, suggesting SSY is best paired with inflation-beating investments.

- Access and Awareness: In some regions, limited access to banking services or calculators reduces the scheme’s effectiveness.

A sukanya samriddhi yojana return calculator helps illuminate these constraints and suggests complementary strategies.

Policy Framework and the Role of SSY in Social Welfare

SSY sits at the nexus of financial inclusion, women empowerment, and social welfare. As part of the broader policy framework, the scheme encourages female education and supports demographic goals. Policymakers use data from SSY uptake and modeled projections (often based on many sukanya samriddhi yojana return calculator simulations) to assess the effectiveness of targeted interventions.

For governments and NGOs, ensuring that families understand how the sukanya samriddhi yojana return calculator projects outcomes is part of financial literacy campaigns that enhance social impact.

Financial Planning: Integrating SSY into a Holistic Portfolio

A sukanya samriddhi yojana return calculator is best used as a component in a multi-asset plan. Financial planners recommend a layered approach:

- Guaranteed Base: SSY provides the low-risk core—use a sukanya samriddhi yojana return calculator to size this base.

- Growth Layer: Equity mutual funds or child-specific SIPs can aim for higher real returns.

- Insurance Layer: Adequate life and health insurance for earning members protect the plan.

- Contingency Buffer: Liquid savings to handle short-term shocks without dipping into SSY.

By modeling each layer’s projected outcomes and interactions, the sukanya samriddhi yojana return calculator informs the right allocation and contribution schedule.

Technology and Tools: Choosing the Right Calculator

Not all calculators are identical. When selecting a sukanya samriddhi yojana return calculator, look for:

- Up-to-date Interest Rates: The calculator should allow you to set the current rate and adjust for future rate scenarios.

- Flexible Deposit Schedules: Annual, quarterly, or lump-sum options improve realism.

- Tax Treatment Display: Showing tax deductions and post-tax equivalents helps planning.

- Year-wise Projection: A year-by-year schedule helps visualize the compounding effect.

- Exportable Reports: For record-keeping and sharing with advisors.

Use a verified bank or government portal calculator, or a trusted financial website’s tool, to ensure accuracy when you model the sukanya samriddhi yojana return calculator outputs.

Future Prospects: Where SSY Might Head

As education costs rise and social policy evolves, SSY may see changes aiming to preserve its attractiveness. Possible enhancements include adjustments to interest rate-setting, higher annual contribution caps, or more flexible withdrawal terms. For forward-looking parents, running long-horizon scenarios in a sukanya samriddhi yojana return calculator helps prepare for such shifts.

Moreover, digital initiatives may increase accessibility: mobile apps or integrated calculators in banking platforms can make it easier to track SSY accounts and use the sukanya samriddhi yojana return calculator as a routine financial planning tool.

Practical Example: Using the Calculator to Set a Target

Consider a practical scenario where parents want a target corpus of ₹10 lakh by the time their daughter turns 21. Using a sukanya samriddhi yojana return calculator, they can input current interest rates, their planned deposit frequency, and tenure to see required contributions. If the calculator shows a shortfall, they can model increased yearly deposits or supplement SSY with equity investments to reach the goal.

This step-by-step customization makes the sukanya samriddhi yojana return calculator a central element in real-world planning.

Advocacy and Financial Literacy: Making Calculators More Accessible

While the sukanya samriddhi yojana return calculator is powerful, its usefulness depends on access and understanding. Financial literacy programs aimed at mothers, guardians, and grassroots workers can demystify the calculator’s outputs and encourage disciplined participation. NGOs and state governments can partner with banks and post offices to host workshops that allow families to use the sukanya samriddhi yojana return calculator in a guided setting.

FAQs

Conclusion: Making SSY Work for Your Family

The sukanya samriddhi yojana return calculator is more than a mathematical tool—it’s a compass for long-term financial planning for a girl child. By converting intentions into quantified outcomes, the calculator supports disciplined saving, informed comparisons with other instruments, and strategic adjustments as life unfolds. Whether you live in a metropolitan center or a remote village, the interplay of government policy, state-level initiatives, and disciplined personal finance can be navigated with confidence when you regularly use a sukanya samriddhi yojana return calculator.

Use the calculator early, review annually, and consider SSY as the secure core of a broader portfolio designed to meet the education, empowerment, and welfare objectives for the girl child. With thoughtful planning and consistent use of financial tools like the sukanya samriddhi yojana return calculator, families can meaningfully increase the likelihood that their daughters will have the resources they need to thrive.

bg